Couples choose to manage their individual and combined finances in many different ways, most having individual savings accounts and pension pots acquired from an assortment of jobs. Understanding the financial contribution that both parties are bringing to the retirement phase of life can be tricky.

I’ve created a google sheets spreadsheet so that my wife and I can track our investment pots, current and future income and our expenditure to determine how long our money will last. It enables us to do some scenario planning such as the impact of retirement age or monthly expenditure on our long-term financial stability.

I’ve made the couples retirement planning spreadsheet available for you all to copy to your own Google Drive so that you can review your combined and individual state of Financial Independence. When you click on the link please don’t ask me for edit access to my copy - just create your own copy by saving to your own google drive.

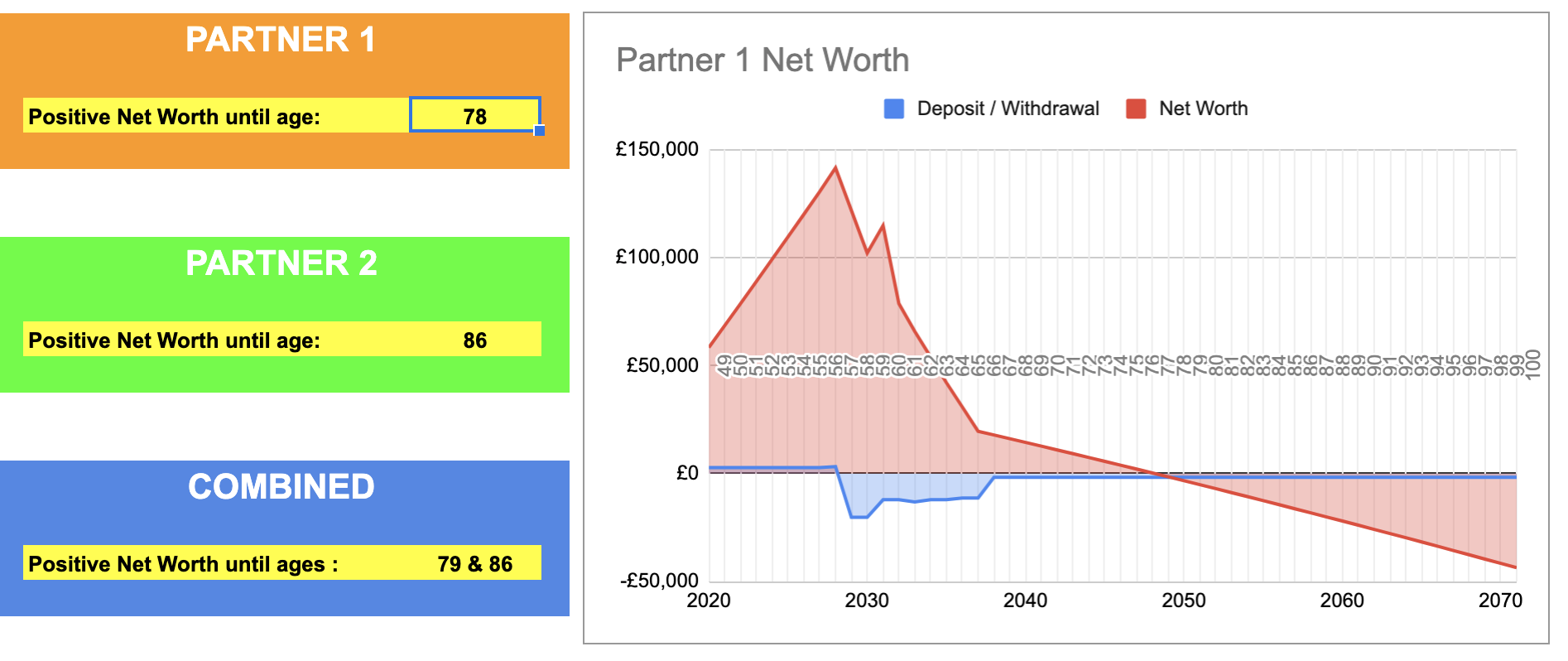

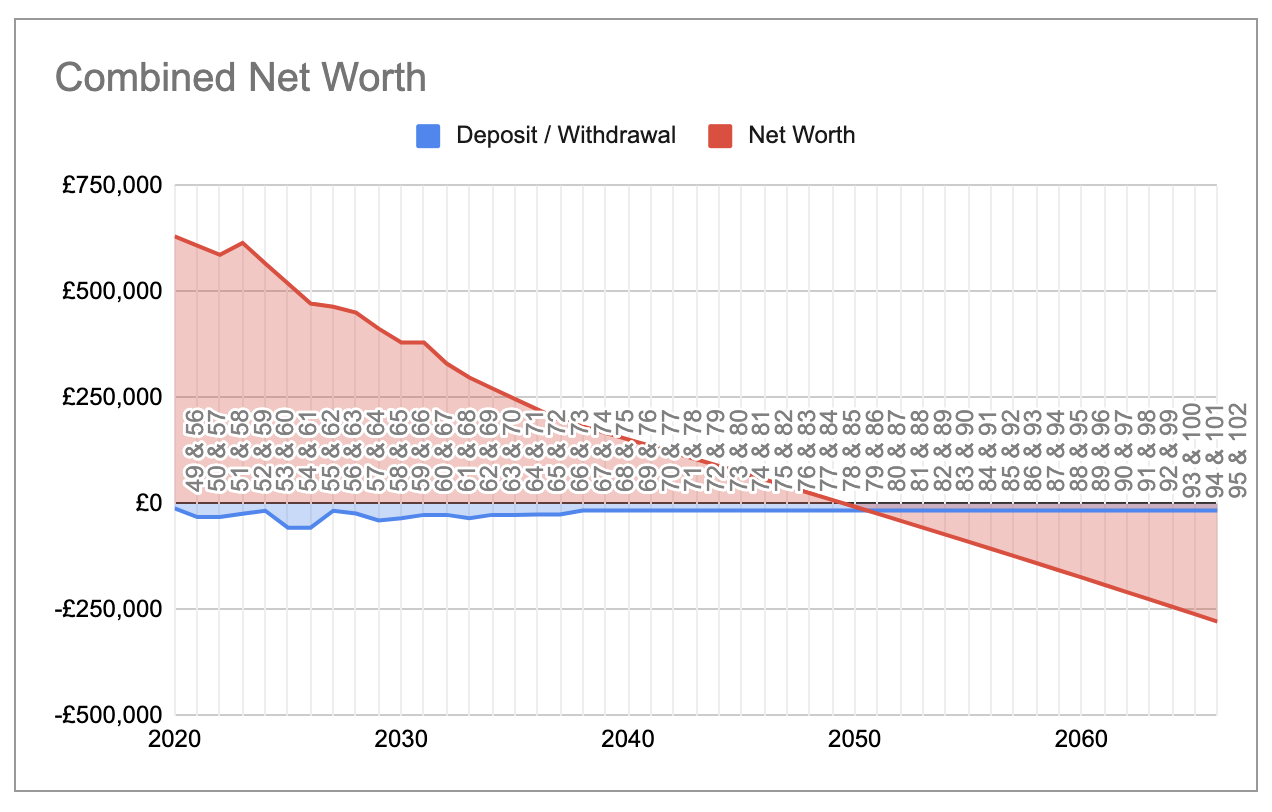

We’ve both incurred some financial shocks in recent years, such as redundancy and financially catastrophic (but mentally rewarding) career changes. It’s been really useful to see our financial position laid out so clearly. For me it provides some reassurance that we will be ok and that our retirement years do not need to be characterised by hardship in any way. I tend to be a little cautious and would prefer not to see my net worth dipping below zero until I’m at least 100, so it means I won’t likely be retiring before I reach 60. However, if my income improves over the coming years, and why the heck wouldn’t it, early retirement might well be back on the cards.

Inspiration for the Couples Retirement Planner

FIRE or Financial Independence Retire Early is all the rage nowadays. It’s perhaps come a bit too late for me to exploit to the full but the concept is simple and pretty inspiring. If you can save 40 times your annual expenditure you will have achieved financial independence and can retire immediately.

This concept is compelling and proponents work to drmatically drive down their expenditure using techniques like geopgraphic arbitrage (living abroad) or just general downsizing. They also drive up their income and probably don’t opt for salary slashing career changes in their mid-life.

I read about FIRE in (Amazon links):

all of which are worthwhile reads for anyone concerned about their finanical future.

Advice tends to be very US centric though while my spreadsheet will be more useful to UK residents. The concepts in the FIRE books are still relevant though and I’d recommend them particularly to the younger generation who are concerned about their inability to get on the property ladder - it could be your lifeline to financial freedom.

How to Use the Couples Retirement Planning Spreadsheet

Link to the Couples Retirement Planning Spreadsheet - please just save your own copy rather than asking me for edit access to my version.

If you find it useful, please consider a donation towards my hosting costs.

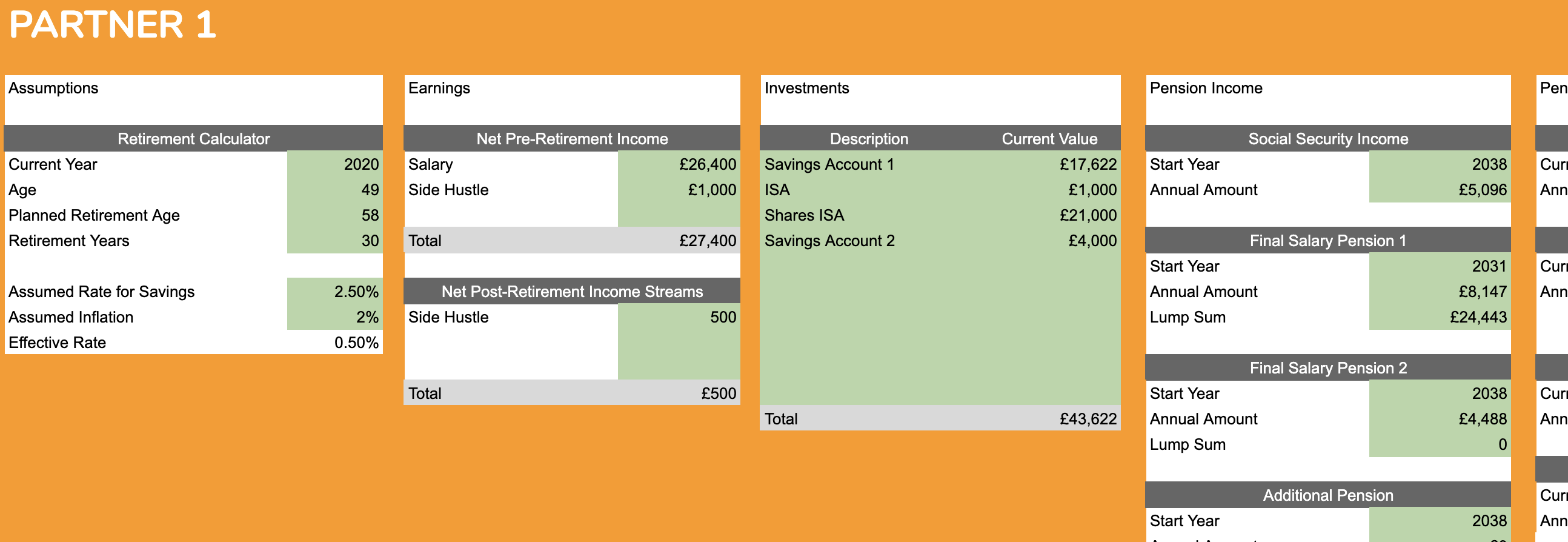

The Config tabs are where all the action is at. At the top there are some cells shaded in khaki where you should fill in all your own details such as planned retirement age, assorted incomes, pension pots, expenditure budgets etc. I’ve pre-populated with some example figures (loosely based on my own scenario).

Underneath the data settings are some charts and a little dashboard showing what age you will be when your pot finally runs out - if indeed it does! Some people wish to ensure there’s a substantial nest egg left to pass onto offspring, while others are content to reach the finish line with only coppers left….. It’s worth noting that I assume my budget will continue at the same rate throughout my retirement which is probably not likely. In order not to ever dip into the red I may just need to cut my cloth a bit and start living within my means at the point at which my net worth runs out. If I have pensions or annuities or a state pension, I will still have that income!

Here’s the all important combined net worth picture - this is a partnership for the longhaul, afterall.

Couples Retirement Planning Spreadsheet - Details

Hopefully the configuration details are clear enough but here are a few notes about each section.

Assumptions

These are mostly obvious.

Assumed rate for savings is a gross annual savings figure. Typically investment planners would work on the basis of 5-7% but that would require you to be investing in quite an aggressive fashion with presumably a high proportion of stock market exposure. I’m cautious and as COVID19 is playing havoc with stock markets and interest rates, I’m plumping for a miserable 2.5%.

I’ve also assumed inflation at 2%.

The important figure is the Effective Rate which is your annual savings return less inflation. This is the percentage that is applied across all your investment pots and allows you to avoid hideous inflated expenditure calculations. Everything can be expressed in terms of todays value.

Variable Rates of Return

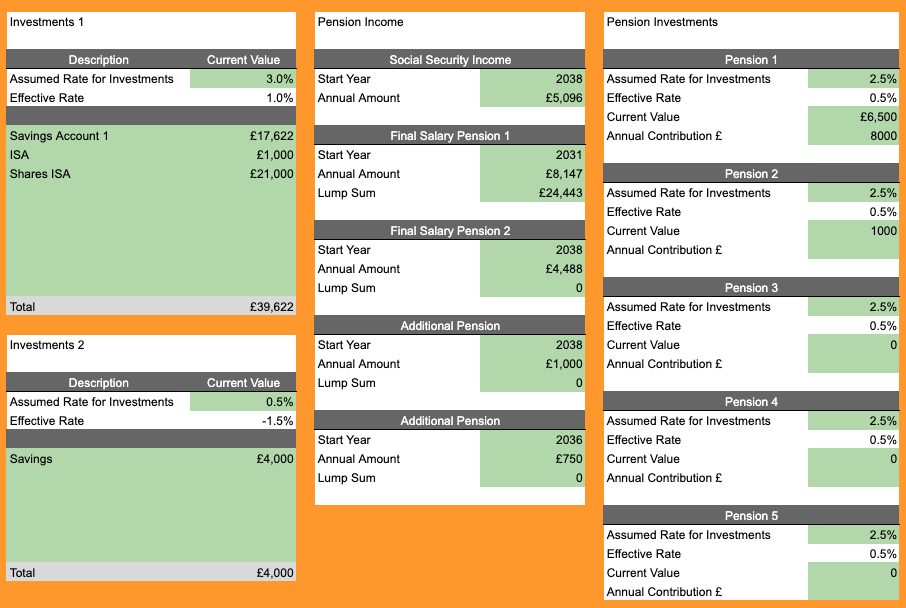

Following feedback from some early users of my spreadsheet, I have now added some additional functionality for people who may prefer to model different rates of return for investments, pensions and plain old cash savings. You can now add an ‘Assumed Rate for Investments’ for two categories of investments and for 5 different pension pots.

However this added complexity could catch you out! I model the difference between budgeted expenditure and income as a ‘net contribution impact to investments’ and compound this at the Effective Rate (cell C13) in your config. I am not choosing which investment pot to withdraw from.

I have now added an ‘assumed rate for withdrawals’ in the config sheet. I suggest that you make this value closer to the higher rates of investment returns you are modelling. To be more accurate it would be a weighted blend of interest rates with some assumptiosn made about which pots you would withdraw from first but that is beyond the scope of this tool. At that stage you are straying well and truly into the realms of needing a financial advisor and probably quite a good one.

This new ‘assumed rate for withdrawals’ will be used whenever the net contribution suggests a withdrawal is required and it should give you further confidence that investment compounding is not running away with itself.

Earnings

Hopefully obvious. There’s space to add a few different income sources. Note that there’s a section for current income and post retirement income which could be of use where you have passive income sources or a desire to continue some casual work.

Investments

These are just savings pots other than specific pension investments. So stocks, shares, ISAs bonds, property - whatever interest bearing assets you have. Not your own home though - that’s an expense and if you don’t know what I’m talking about, read Rich Dad, Poor Dad

Pension Income and Pension Investments

I’ve split my pensions into two categories. The first being for those that will definitely be converted to an income at a certain age such as social security pensions and final salary pensions.

I’ve also got a pension investment list which includes stakeholder pensions and other employment pensions that I can either take as a lump sum or choose to purchase an annuity.

Expenditure

This is my monthly budget, with the categories that I use in the most fabulous YNAB - You Need a Budget - Budgeting Software. There are two columns, one for now and one to reflect the hopefully reduced post retirement expectation.

Annual Splurges

The assumption is that anything left (positive or negative) after my budgeted expenditure will be invested in (or withdrawn from) an interest bearing vehicle of some kind. This splurges table is just a way for me to account for the unexpected stuff that I haven’t chosen to budget for - although if you do use YNAB, you will know that I should have budgeted for it!

It makes me happier to account for irregular future expenses like the occasional mega holiday or car replacement.

Net Worth Tab

This is where the calculations happen. You don’t need to touch this sheet, although you can if you know what you are doing. If you don’t, you will break it. I haven’t protected anything.

So thats it - go forth and plan and then enjoy your retirement! Let me know how you get on with the spreadsheet and if you can think of any improvements.

Updating for the New Year

This now my second year of using this spreadsheet. I decided to handle the New Year by creating a new copy of the spreadsheet eg RetirementPlans2026 and then just refreshing the config details like start year and age etc. That way I can flip between my plans from the start of each year (by selecting the relevant spreadsheet) and see how things have been progressing. Whether it was a better or worse year than I had hoped for and whether I need to make adjustments.

Keep checking back for updates

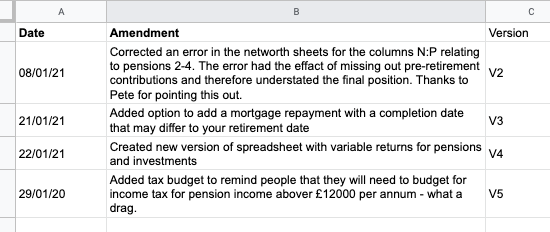

Unfortunately by sharing this spreadsheet and letting you make your own copy to populate and edit as you wish, I can’t then keep you informed of any error corrections or improvements that I make following feedback. I have now added a changelog to the front of the original spreadsheet so you could always keep an eye on that. That might sound a bit onerous but bear in mind I am not a financial advisor so you need to do your own due diligence with your financial planning.

This article is for informational purposes only, it should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any major financial decisions.

Comments